Localization

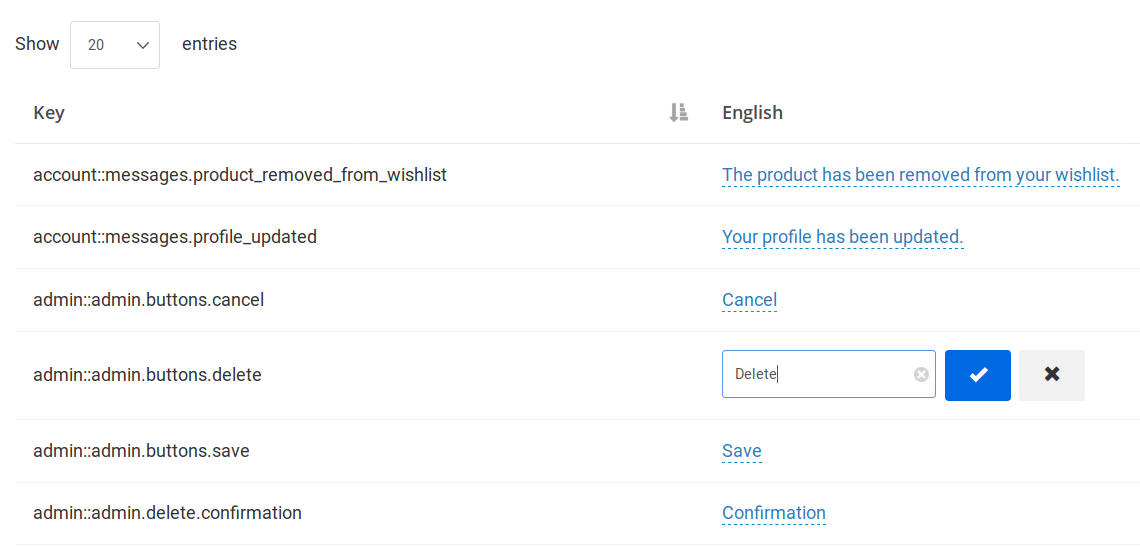

Translations

You can translate your store's strings from the built-in translation editor for all supported locales. You can also use the translation editor for editing the default strings.

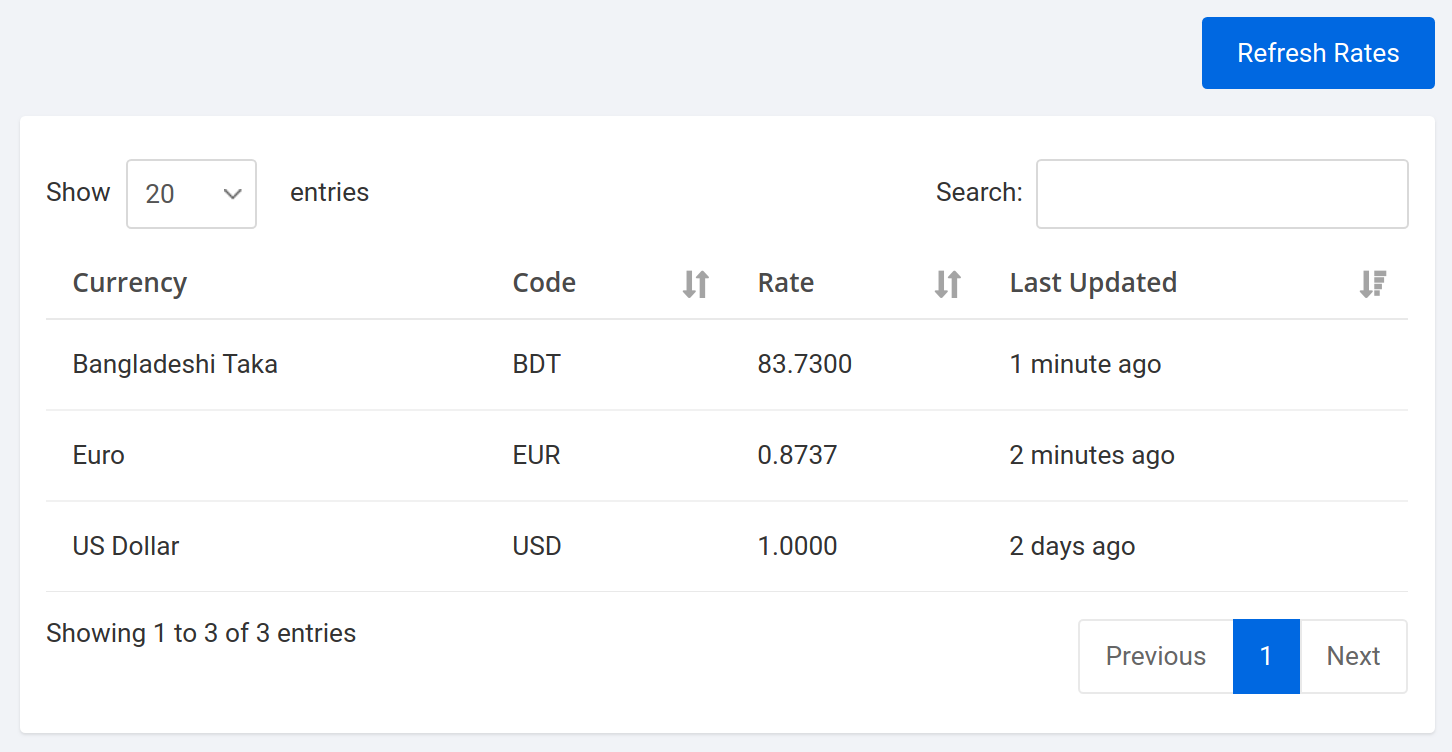

Currency Rates

Currency rates are used for determining the product price when a customer changed the currency. If your store only supports one currency, then you don't need to update currency rates.

You can use third-party service like Fixer, 1Forge, or Currency Data Feed to refresh currency rates. Click on the Refresh Rates button to refresh currency rates. If a third-party service is not configured, configure it from Settings > Currency.

WARNING

If a third-party service doesn't support a currency, then currency rate will set to 1.0000. You then manually need to update the rate for that currency.

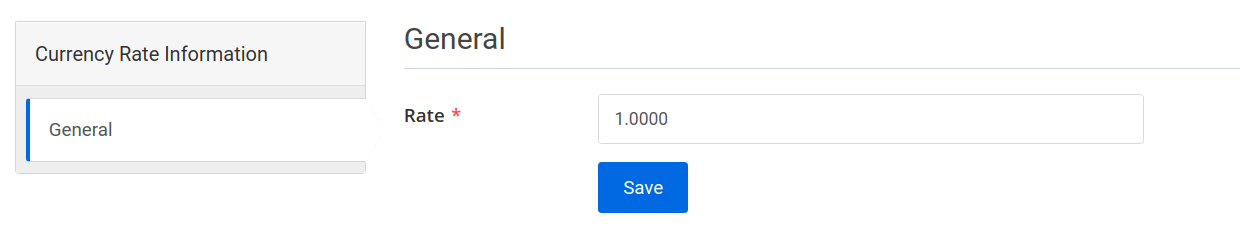

Edit Currency Rate

Click on the table row to edit the rate of the currency.

General

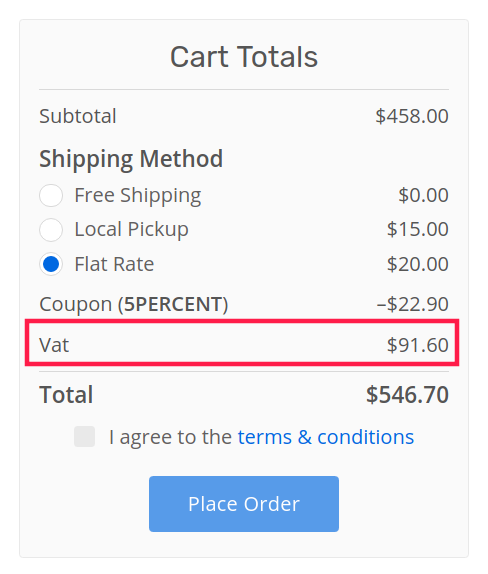

Taxes

Taxes can be configured for taxable products in your store. After creating a tax add that tax class to all the taxable products.

Tax will be added automatically to the cart during the checkout process.

TIP

Multiple taxes may be added to the cart based on the cart products.

Create Tax

Navigate to Taxes > Create Tax to create a new tax.

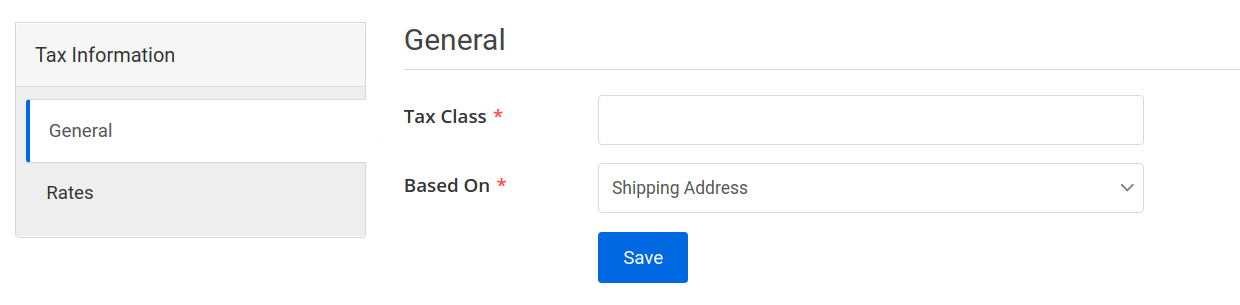

General

- Tax Class (translatable): The label of the tax class.

- Based On: Tax can be based on Shipping Address, Billing Address, or Store Address.

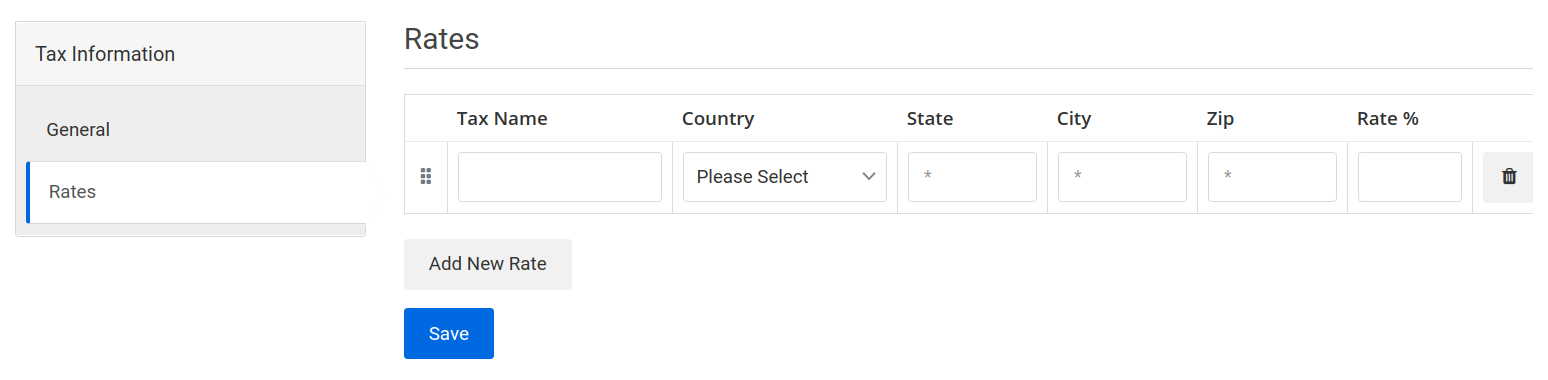

Rates

Best matched (address) tax will be added to the cart.

- Tax Name (translatable): The name of the tax.

- Country: The country where this tax rate will be applied.

- State: The state where this tax will be applied.

- City: The city where this tax will be applied.

- Zip: The zip where this tax will be applied.

- Rate: The percentage tax rate will be calculated based on the subtotal of the shopping cart.